Digital Transformation and AI in Banking

Digital Automation for Banking and Financial Services

17 Modules Of Rare Industry-Leading Training

$197 $397 for entire 30-chapter bundle if you purchase now!

Watch a preview of an intro to the course

The Most Comprehensive Course Ever Put Together On The Subject - From Basic to Advanced

📌 Who Is This Course For?

✔️ Bankers & Financial Advisors

✔️ Loan & Wealth Management Professionals

✔️ Fintech Entrepreneurs & Business Owners

✔️ Anyone in Financial Services

✔️ Anyone who wants to understand modern banking and finance

Here's what some people had to say about the course...

✅ 1. “Finally Understand Data Like a Pro”

⭐️⭐️⭐️⭐️⭐️ "This course made complex data concepts easy to understand. I can now organize, clean, and interpret data confidently at work. It’s the best investment I’ve made in my career." — David A., Business Analyst

✅ 2. “From Data Chaos to Clarity”

⭐️⭐️⭐️⭐️⭐️ "Our company’s reports used to be full of errors. After taking this course, I implemented a clear data governance process that impressed management. Highly recommended!" — Maria T., Operations Manager

✅ 3. “Made Me a Data-Driven Decision Maker”

⭐️⭐️⭐️⭐️⭐️ "I never realized how much poor data quality affected my decisions. This course showed me how to collect, store, and use data correctly. Now my reports actually drive results." — Samuel K., Finance Officer

✅ 4. “Turned My Career Around”

⭐️⭐️⭐️⭐️⭐️ "I was struggling to get noticed in my analytics role. After applying what I learned here, I landed a promotion within two months. This course delivers real-world value." — Lydia P., Data Analyst

✅ 5. “Brilliant for Beginners and Professionals Alike”

⭐️⭐️⭐️⭐️⭐️ "Even as someone new to data management, I understood every module. The explanations are clear, practical, and actionable. I use these lessons every single day now." — Henry O., Junior Accountant

✅ 6. “Gave Me Structure and Confidence with Data”

⭐️⭐️⭐️⭐️⭐️ "Before this, managing data felt overwhelming. The frameworks and examples in the course helped me create order and efficiency in my projects. Absolute must-have." — Chinyere N., Project Coordinator

🚀 Modules - What You’ll Learn in This Course

30 Powerful Chapters Merged Into One Complete package!

The New Digital Banking Landscape

Explore how technology, regulation, fintechs, and changing customer expectations are reshaping the global banking industry.Banking Transformation Framework & Operating Model

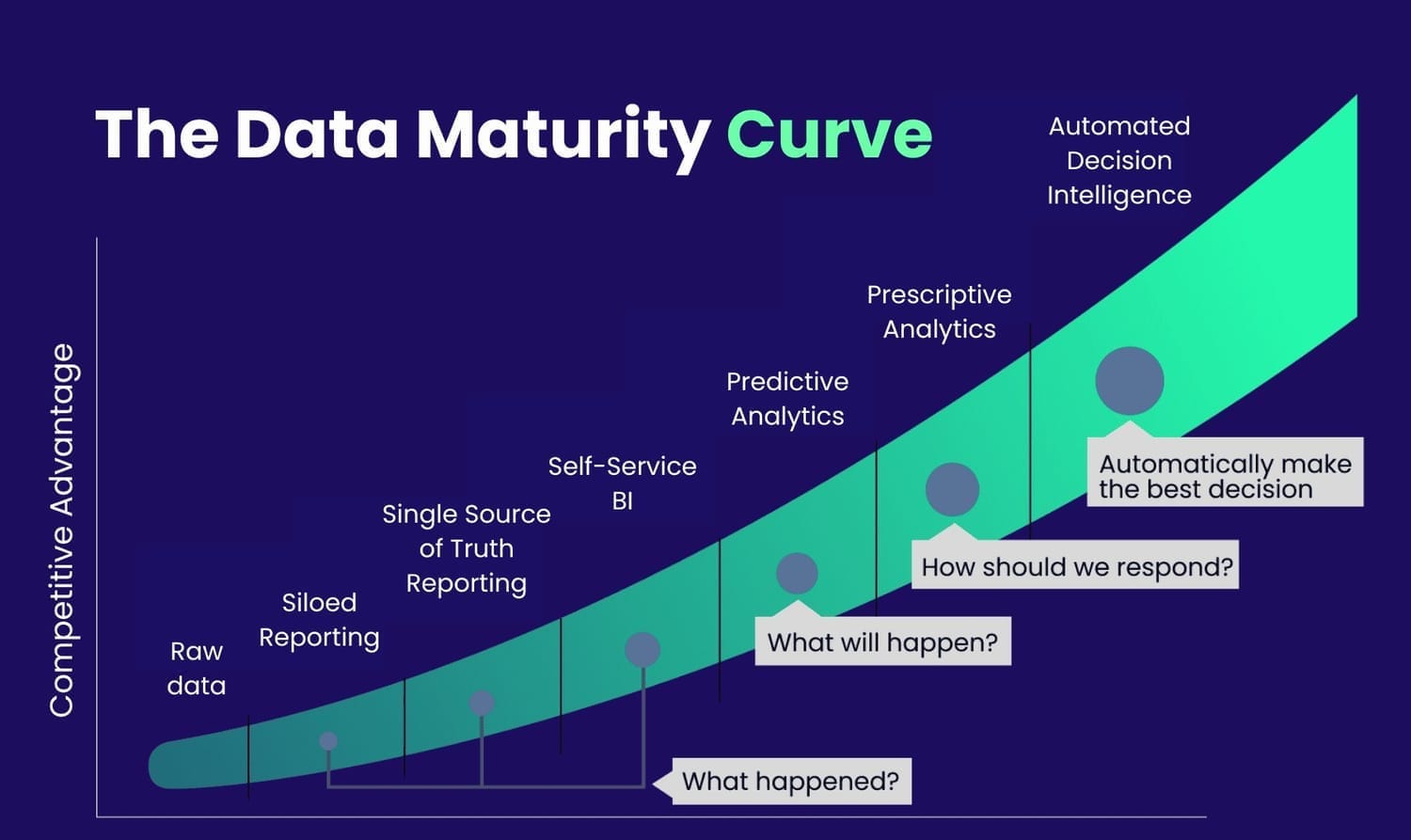

Learn a practical end-to-end framework for structuring digital and AI transformation across people, process, technology, and governance.Digital Maturity Assessment & Roadmap Design

Understand how to assess a bank’s current digital maturity and design a realistic, phased transformation roadmap.Cloud Transformation for Banking

Discover how banks adopt cloud safely and securely to improve scalability, resilience, and speed-to-market.Core Modernization Options (Temenos, Finacle, Murex, Endur)

Compare leading core banking platforms and modernization strategies, including re-platforming, wrapping, and replacement.Data Modernization & Warehouse Re-architecture

Learn how to modernize legacy data warehouses into scalable, analytics-ready platforms that power AI and insights.API Banking & Open Banking Ecosystem

See how APIs enable open banking, ecosystem partnerships, and new digital revenue models.Cloud-Native Microservices Architecture

Understand how microservices and containerized architectures enable agility, resilience, and continuous innovation.Digital Identity & Customer Experience Platforms

Explore digital identity, onboarding, and omnichannel experience platforms that drive seamless customer journeys.Process Automation & Workflow Digitization

Learn how RPA, BPM, and workflow automation eliminate manual processes and improve operational efficiency.Platform Ecosystems & Fintech Collaboration

Understand how banks build platform ecosystems and collaborate with fintechs to accelerate innovation.Event-Driven Banking & Real-Time Processing

Discover how real-time, event-driven architectures power instant payments, alerts, and intelligent decisioning.Data Governance & Data Quality in Digital Banks

Learn how strong data governance ensures trusted, compliant, and AI-ready data across the enterprise.Master & Reference Data Management

Understand how mastering customer, product, and reference data creates a single source of truth for the bank.Data Engineering for AI Platforms

Explore how data pipelines, feature stores, and streaming data enable scalable AI solutions.Model Development & MLOps in Banking

Learn how AI models are built, deployed, monitored, and continuously improved in regulated banking environments.Responsible AI & Model Governance

Understand fairness, bias, explainability, and regulatory requirements for deploying AI responsibly in banking.AI Use Case Framework for Banking

Learn a structured approach to identifying, prioritizing, and scaling high-impact AI use cases.Credit Scoring & Underwriting AI

Explore how AI transforms credit risk assessment, underwriting decisions, and loan approvals.Fraud Detection & Transaction Anomaly Analytics

Learn how machine learning detects fraud patterns and anomalies in real time to reduce losses.Personalization & Next Best Offer

Discover how AI drives hyper-personalized offers, recommendations, and customer engagement.Forecasting & Financial Planning AI

Understand how AI improves forecasting, liquidity management, and enterprise financial planning.NLP & Document Processing in Banking

See how natural language processing automates document review, KYC, contracts, and customer communications.Explainable AI (XAI) & Model Monitoring

Learn how to explain AI decisions and continuously monitor model performance and risk.Enterprise AI Platform Architecture

Explore the reference architecture for building scalable, secure, and enterprise-grade AI platforms.Integration with Core Systems (Temenos, Finacle, Murex, Endur)

Understand how AI platforms integrate seamlessly with core banking and treasury systems.Cloud AI Services & Cost Optimization

Learn how to leverage cloud AI services efficiently while controlling costs and maximizing ROI.Change Management & Digital Culture

Understand how leadership, culture, and skills enable successful digital and AI transformation.Case Study — Enterprise AI Platform for Credit Decisioning

Walk through a real-world case study showing how an enterprise AI platform improves credit decisions end-to-end.Capstone Project & Presentation

Apply everything you’ve learned by designing and presenting a complete digital and AI transformation solution for a bank.

✅ 1. The New Digital Banking Landscape

Detailed Overview:

This chapter sets the context for digital transformation by examining how customer expectations, fintech disruption, regulation, and emerging technologies are redefining banking globally.

What you’ll learn:

Key forces reshaping modern banking

How incumbents compete with fintechs and big tech

Why digital and AI transformation is no longer optional

✅ 2. Banking Transformation Framework & Operating Model

Detailed Overview:

Learn a structured transformation framework that aligns strategy, operating model, technology, governance, and execution.

What you’ll learn:

End-to-end digital transformation building blocks

Target operating models for digital banks

How to align business, IT, and data teams

Play to watch sample preview

✅ 3. Digital Maturity Assessment & Roadmap Design

Detailed Overview:

This chapter shows how to objectively assess a bank’s current digital capabilities and translate findings into a practical roadmap.

What you’ll learn:

Digital maturity dimensions and benchmarks

Gap analysis techniques

How to build a phased, achievable roadmap

✅ 4. Cloud Transformation for Banking

Detailed Overview: Explore how banks adopt cloud technologies while addressing security, regulatory, and risk considerations.

What you’ll learn:

Cloud service models and deployment patterns

Regulatory and risk considerations for banks

Cloud adoption strategies and best practices

What people have said about Data Architecture...

✅ “Made technical architecture easy to grasp”

⭐️⭐️⭐️⭐️⭐️ "I finally understand how all our databases connect and flow together." — George L., Systems Analyst

✅ “Clarity at last!”

⭐️⭐️⭐️⭐️⭐️ "No fluff — just practical explanation of architectures I can actually use." — Moses A., Database Administrator

✅ “Brilliant breakdown of a complex topic”

⭐️⭐️⭐️⭐️⭐️ "I implemented the architecture model from this module for my team immediately." — Jane R., Data Engineer

✅ 5. Core Modernization Options (Temenos, Finacle, Murex, Endur)

Detailed Overview: Understand different approaches to modernizing core banking and treasury platforms using leading solutions.

What you’ll learn:

Core replacement vs. modernization strategies

Strengths of major banking platforms

How to choose the right approach for your bank

Play to watch sample preview

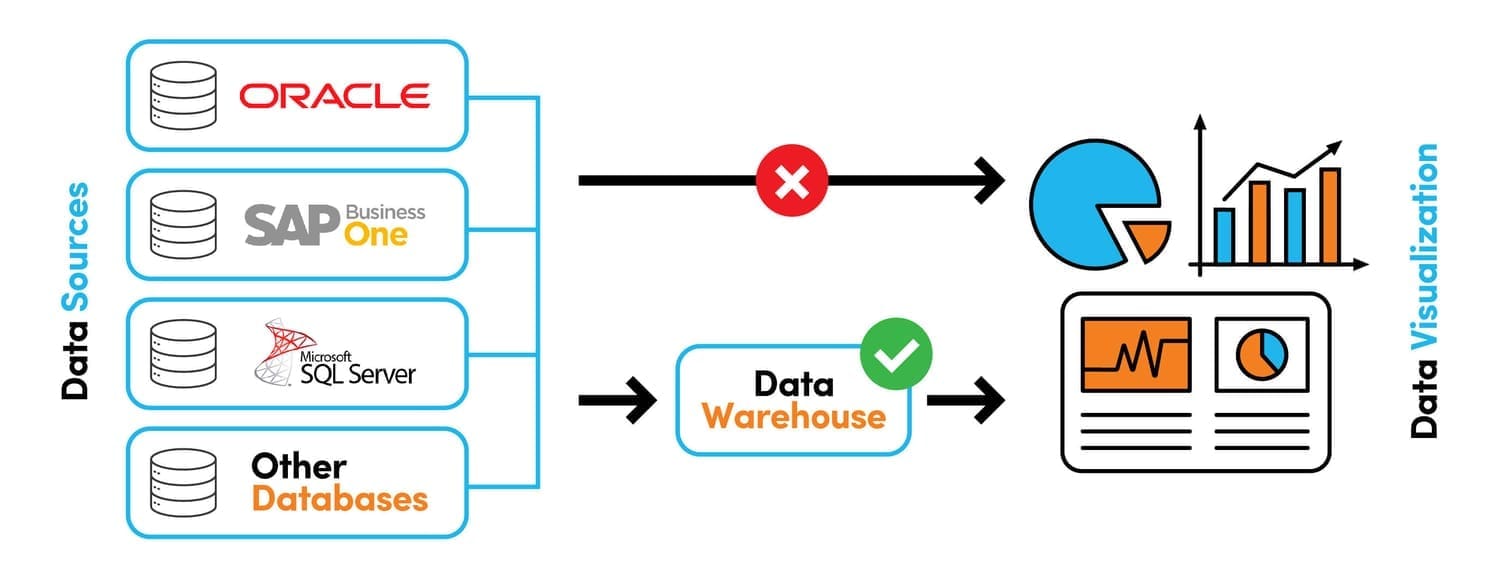

✅ 6. Data Modernization & Warehouse Re-architecture

Detailed Overview:

Learn how banks modernize legacy data warehouses into scalable, cloud-ready analytics platforms.

What you’ll learn:

Limitations of traditional data warehouses

Modern data architectures (lakehouse, streaming)

Enabling real-time analytics and AI

✅ 7. API Banking & Open Banking Ecosystem

Detailed Overview: This chapter explains how APIs enable open banking, ecosystem partnerships, and new digital products. What you’ll learn:

API-driven banking architectures

Open banking regulations and standards

Monetization and ecosystem strategies

✅ 8. Cloud-Native Microservices Architecture

Detailed Overview: Discover how cloud-native design principles improve scalability, resilience, and speed of innovation.

What you’ll learn:

Microservices vs. monolithic architectures

Containers, orchestration, and DevOps

Designing for scalability and resilience

✅ 9. Digital Identity & Customer Experience Platforms

Detailed Overview: Explore how digital identity and CX platforms enable seamless onboarding and omnichannel experiences. What you’ll learn:

Digital identity and KYC technologies

Customer journey orchestration

Enhancing trust and customer satisfaction

✅ 10. Process Automation & Workflow Digitization

Detailed Overview:

Learn how banks digitize and automate processes to reduce costs and improve turnaround time.

What you’ll learn:

RPA, BPM, and workflow tools

Identifying automation opportunities

Measuring efficiency and ROI

✅ 11. Platform Ecosystems & Fintech Collaboration

Detailed Overview: Understand how banks evolve into platforms and collaborate with fintechs to accelerate innovation. What you’ll learn:

Platform business models in banking

Partner onboarding and governance

Value creation through ecosystems

✅ 12. Event-Driven Banking & Real-Time Processing

Detailed Overview:

This chapter explains how event-driven architectures enable real-time decisioning and responsiveness.

What you’ll learn:

Event streaming and messaging concepts

Real-time use cases in banking

Designing responsive digital systems

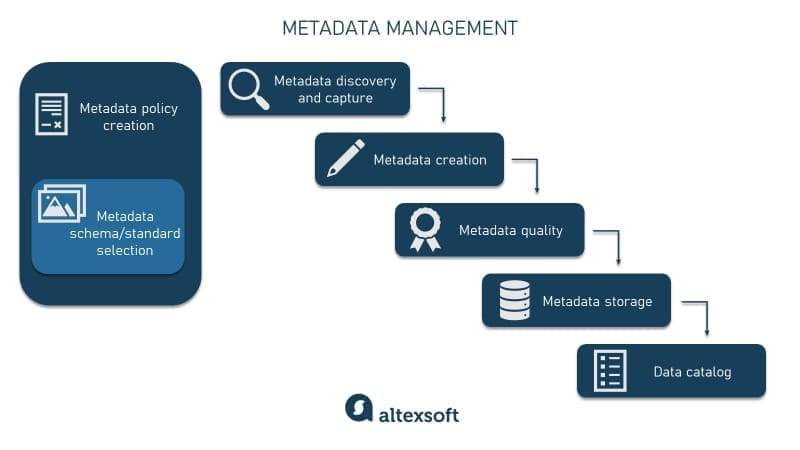

✅ 13. Data Governance & Data Quality in Digital Banks

Detailed Overview:

Learn how strong governance ensures trusted, compliant, and AI-ready data.

What you’ll learn:

Data ownership and stewardship models

Data quality frameworks

Regulatory and compliance considerations

✅ 14. Master & Reference Data Management

Detailed Overview:

Explore how mastering critical data entities creates consistency across systems and channels.

What you’ll learn:

MDM concepts and architectures

Managing customer, product, and reference data

Enabling a single source of truth

Play to watch sample preview

✅ 15. Data Engineering for AI Platforms

Detailed Overview:

This chapter focuses on the data pipelines and engineering foundations required for scalable AI.

What you’ll learn:

Batch and streaming data pipelines

Feature engineering and feature stores

Designing AI-ready data platforms

Play to watch sample preview

✅ 16. Model Development & MLOps in Banking

Detailed Overview:

Learn how AI models are built, deployed, and managed in production banking environments.

What you’ll learn:

Model development lifecycle

CI/CD for machine learning

Monitoring and retraining models

✅ 17. Responsible AI & Model Governance

Detailed Overview:

Understand how banks ensure ethical, fair, and compliant use of AI.

What you’ll learn:

Bias, fairness, and explainability

Model risk management

Regulatory expectations for AI

Play to watch sample preview

✅ 18. AI Use Case Framework for Banking

Detailed Overview:

Learn a structured approach to identifying and scaling AI use cases across the bank.

What you’ll learn:

Use case identification and prioritization

Value vs. feasibility assessment

Scaling AI across business units

✅ 19. Credit Scoring & Underwriting AI

Detailed Overview:

Explore how AI transforms credit risk assessment and loan decisioning. What you’ll learn:

Traditional vs. AI-driven credit models

Alternative data and advanced analytics

Improving approval speed and accuracy

Play to watch sample preview

✅ 20. Fraud Detection & Transaction Anomaly Analytics

Detailed Overview:

Learn how machine learning detects fraud and suspicious behavior in real time.

What you’ll learn:

Fraud patterns and anomaly detection

Supervised vs. unsupervised models

Reducing false positives

✅ 21. Personalization & Next Best Offer

Detailed Overview:

This chapter shows how AI drives personalized customer engagement and cross-selling.

What you’ll learn:

Recommendation engines

Customer segmentation and behavior analysis

Increasing customer lifetime value

Play to watch sample preview

✅ 22. Forecasting & Financial Planning AI

Detailed Overview: Understand how AI enhances forecasting, planning, and decision support.

What you’ll learn:

Time-series forecasting techniques

AI-driven financial planning

Scenario analysis and stress testing

✅ 23. NLP & Document Processing in Banking

Detailed Overview: Learn how natural language processing automates document-heavy banking processes.

What you’ll learn:

OCR and NLP fundamentals

Use cases in KYC, contracts, and support

Efficiency gains through automation

Play to watch sample preview

✅ 24. Explainable AI (XAI) & Model Monitoring

Detailed Overview: Explore techniques for making AI models transparent and continuously monitored.

What you’ll learn:

Explainability techniques (SHAP, LIME)

Model drift detection

Performance and risk monitoring

✅ 25. Enterprise AI Platform Architecture

Detailed Overview: This chapter presents a reference architecture for enterprise-scale AI platforms.

What you’ll learn:

Core components of AI platforms

Security and scalability considerations

Integrating data, models, and users

Play to watch sample preview

✅ 26. Integration with Core Systems (Temenos, Finacle, Murex, Endur)

Detailed Overview: Learn how AI platforms integrate with core banking and treasury systems.

What you’ll learn:

Integration patterns and APIs

Real-time vs. batch integration

Avoiding disruption to core systems

✅ 27. Cloud AI Services & Cost Optimization

Detailed Overview: Understand how to use cloud AI services efficiently while managing costs.

What you’ll learn:

Managed AI services and tools

Cost drivers and optimization strategies

Maximizing ROI from cloud AI

Play to watch sample preview

✅ 28. Change Management & Digital Culture

Detailed Overview: This chapter focuses on the human and cultural side of digital transformation.

What you’ll learn:

Leading digital change

Building digital and AI skills

Embedding innovation culture

✅ 29. Case Study — Enterprise AI Platform for Credit Decisioning

Detailed Overview: A real-world case study demonstrating end-to-end AI platform implementation for credit decisioning.

What you’ll learn:

Architecture and design decisions

Data, model, and governance integration

Measurable business outcomes

Play to watch sample preview

✅ 30. Capstone Project & Presentation

Detailed Overview: Apply all concepts by designing and presenting a complete digital and AI transformation solution.

What you’ll learn:

End-to-end solution design

Practical application of course concepts

How to communicate transformation value

Here's what other people had to say after going through the course...

✅ 1. “Exactly What Every Modern Professional Needs”

⭐️⭐️⭐️⭐️⭐️ "I’ve taken many online courses, but this one stands out. Every lesson is practical, clear, and designed to help you apply data skills immediately. I went from guessing to managing data confidently." — Chuka N., Financial Data Analyst

✅ 2. “This Course Boosted My Career Fast”

⭐️⭐️⭐️⭐️⭐️ "After completing the course, I updated my LinkedIn profile and landed two job interviews within a week. The modules are structured like a real-world masterclass — not theory, but application." — Linda B., Business Intelligence Associate

✅ 3. “A Complete Game-Changer for My Organization”

⭐️⭐️⭐️⭐️⭐️ "Our data was scattered and inconsistent. After implementing what I learned here, we built a unified, clean, and secure data system that’s saving us hours every week." — Emmanuel O., Operations Director

🔥 Course Price & Enrollment Options

Full Course Access:

$997(₦1,500,000)$497 (₦750,000)

📢 Limited Offer: Enroll Today & Get 50% Off! ($497)

Hurry and get this now before it becomes unavailable or the price goes up!

🔴 Enroll Now & Start Learning!

ABOUT

MarketPlacie is a premiere platform that provides access to the hottest and best products and services from the biggest brands on the planet

hello@marketplacies.com

Powered by RPBCS