Understanding Banking and Finance

30 Volumes Of Industry-Leading Training

$97 now just $37 / Volume for 24 hours only!

$997 $497 for entire 30-volume bundle if you purchase now!

The Most Comprehensive Course Ever Put Together On The Subject - From Basic to Advanced

Master the concepts and practices of today's modern banking and finance.

Covers Data Architecture, Data Management, Data Analysis, Data Science, Business Intelligence and lots more...

📌 Who Is This Course For?

✔️ Bankers & Financial Advisors

✔️ Loan & Wealth Management Professionals

✔️ Fintech Entrepreneurs & Business Owners

✔️ Anyone in Financial Services

✔️ Anyone who wants to understand modern banking and finance

Here's what some people had to say about the course...

✅ 1. “From Confused to Confident in Finance”

⭐️⭐️⭐️⭐️⭐️ "Before the course, I avoided finance conversations at work. Now, I lead them. Everything clicked — from credit analysis to interpreting financial statements. Game-changer."— Jasmine K., Customer Success Manager

✅ 2. “Landed My First Finance Job!”

⭐️⭐️⭐️⭐️⭐️ "No finance background, but after finishing this course, I aced my credit analyst interview. The Excel and financial modeling modules gave me the edge."— Alex D., Credit Analyst Trainee

✅ 3. “Better Than My MBA Courses”

⭐️⭐️⭐️⭐️⭐️ "I’ve taken finance in business school, but this was more practical. The Capital IQ, ESG, and FinTech content was especially useful. It’s like a real-world MBA booster."— Monica T., MBA Graduate

✅ 4. “Finally Understand My Business Finances”

⭐️⭐️⭐️⭐️⭐️ "This course taught me how to make smarter decisions with my business. I finally understand budgeting, financial statements, and risk — without relying 100% on my accountant."— Rob S., Small Business Owner

✅ 5. “Everything You Need in One Course”

⭐️⭐️⭐️⭐️⭐️ "This isn’t just one course — it’s 29. From corporate finance to fintech to data science, I finally feel like I ‘get’ how the whole financial system works."— Priya R., FinTech Product Manager

✅ 6. “Made My Career Pivot Possible”

⭐️⭐️⭐️⭐️⭐️ "I was in traditional banking, itching to move into tech. This course gave me the FinTech foundation and confidence to make the switch. I start my new job next week!"— David M., Digital Product Analyst

🚀 Modules - What You’ll Learn in This Course

30 Powerful Courses Merged Into One Complete package!

Gain an overview of the banking industry, its role in the economy, types of banks, and key regulations governing financial institutions. Learn More...

✅ Banking Products and Services

Understand core banking products such as savings accounts, loans, mortgages, investment services, and digital banking solutions. Learn More...

Learn the basics of credit assessment, credit scoring, lending principles, and risk management in credit decisions. Learn More...

Examine different business structures, including sole proprietorships, partnerships, corporations, and their financial implications. Learn More...

Learn basic accounting principles, including the accounting equation, double-entry bookkeeping, and key financial statements. Learn More...

✅ Introduction to Corporate Finance

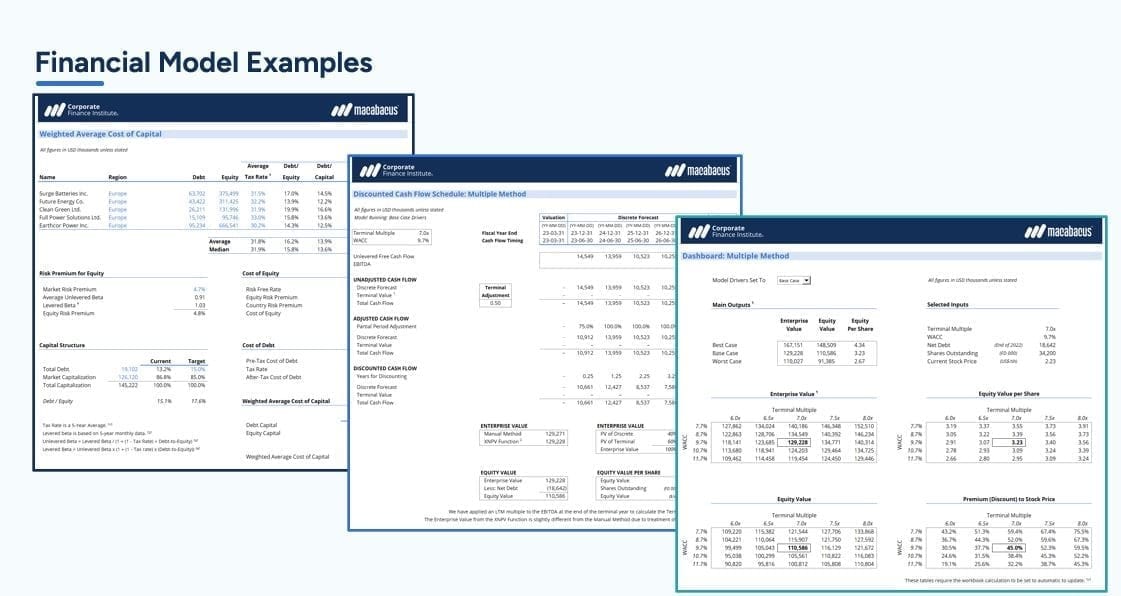

Explore corporate finance concepts such as capital budgeting, cost of capital, financial decision-making, and valuation.

✅ Reading Financial Statements

Develop the ability to analyze and interpret balance sheets, income statements, and cash flow statements to assess business performance.

✅ Excel Crash Course for Finance Professionals

Master key Excel functions, financial modeling, and data analysis techniques essential for finance professionals.

Learn how to use Capital IQ for financial analysis, market research, and investment decision-making.

✅ Economics for Capital Markets

Explore fundamental economic concepts and their impact on capital markets, including supply and demand, monetary policy, inflation, and economic cycles. Learn how macroeconomic indicators influence financial decision-making.

✅ Math Fundamentals of Capital Markets

Master essential mathematical concepts like interest rates, time value of money, probability, and financial modeling techniques.

Discover financial derivatives such as options, futures, swaps, and their role in hedging risks and investment strategies.

✅ Introduction to Business Intelligence

Explore business intelligence tools and techniques used for data-driven decision-making in finance.

Learn key statistical concepts, probability theory, and their applications in financial analysis and risk assessment.

✅ Data Science Fundamentals Understand the basics of data science, including data collection, processing, and analytics for financial applications.

✅ Data Science and Machine Learning

Learn the applications of machine learning and AI in finance, including fraud detection, risk assessment, and algorithmic trading.

✅ Foreign Exchange Essentials Gain insights into the foreign exchange market, currency trading, exchange rate dynamics, and risk management strategies.

✅ Introduction to ESG (Environmental, Social, and Governance)

Understand ESG investing principles, sustainability considerations, and their impact on financial decision-making.

Learn how to use IBIS World for industry research, market analysis, and strategic business planning.

Explore career paths in commercial banking, required skills, and growth opportunities in the sector.

Understand the fundamentals of cryptocurrencies, blockchain technology, and their role in modern finance.

✅ Analyzing Growth Drivers & Business Risks

Examine key factors that drive business growth and identify financial and operational risks affecting businesses.

Learn how to leverage Vertical IQ for industry-specific financial analysis and strategic decision-making.

Explore the evolution of financial technology, including digital payments, robo-advisors, and blockchain innovations.

✅ Financial Analysis Fundamentals

Master financial ratios, valuation methods, and techniques for evaluating company performance.

✅ Fundamentals of Data Analysis in Excel

Learn data manipulation, visualization, and statistical analysis using Excel for finance-related tasks.

Understand trade credit mechanisms, credit risk assessment, and best practices in managing trade finance.

✅ Introduction to Risk Management

Learn risk identification, assessment, and mitigation techniques in banking and finance.

✅ Equity Allocation for Wealth Managers

Discover portfolio diversification, asset allocation strategies, and investment management principles for wealth managers.

Watch a preview of a part of the course

✅ Introduction to Banking

Detailed Overview: Build foundational knowledge of the banking industry, covering traditional banking roles and how modern banking has evolved with regulation and digital transformation.

What You’ll Learn:

Historical evolution from merchant banking to digital-only banks

Key differences between retail, commercial, investment, and central banks

Overview of intermediation: how banks manage deposits and lending

Understand bank balance sheets and where profits come from (net interest margin)

Global banking regulations: Basel Accords, FDIC coverage, stress testing

Breakdown of recent events like Silicon Valley Bank collapse or the 2008 crisis

Play to watch sample preview

What people have said about Introduction to Banking...

⭐️⭐️⭐️⭐️⭐️ "Before this module, I didn’t even know what a central bank did. Now I can hold conversations with finance pros!" — Maria F., University Student

⭐️⭐️⭐️⭐️⭐️ "This was my crash course into the world of banking. It covered history, structure, and modern fintech all in one." — Tyrell K., Startup Founder

⭐️⭐️⭐️⭐️⭐️ "What stood out was how well it connected traditional banking to current digital trends. The examples were up-to-date and practical." — Linda C., Tech Consultant

✅ Banking Products and Services

Detailed Overview: Learn the full suite of products offered by banks to individuals, SMEs, and large corporations, with real-world examples and pricing dynamics.

What You’ll Learn:

Comparison of deposit products (savings, CDs, current accounts) by interest rates, fees, liquidity

Loan types with detailed features: underwriting, amortization, secured vs unsecured

Understanding financial advisory, wealth management offerings, and cross-selling strategies

Overview of digital banking services: API banking, mobile-first platforms, neobanks

Real examples of banking product bundling and client segmentation strategies

Play to watch sample preview

What people have said about Banking Products and Services...

⭐️⭐️⭐️⭐️⭐️ "The module helped me understand the difference between loans and credit lines and how banks price them." — Ahmed R., Finance Intern

⭐️⭐️⭐️⭐️⭐️ "I didn’t know how complex and tailored banking products could be. Now I understand how banks segment their clients and sell strategically." — Sophia V., Business Analyst

⭐️⭐️⭐️⭐️⭐️ "As someone planning to launch a fintech app, this gave me crucial insight into how digital banking services are structured and delivered." — Mike L., App Developer

✅ Fundamentals of Credit

Detailed Overview: Master how banks and financial institutions evaluate creditworthiness, set credit terms, and manage risk in lending operations.

What You’ll Learn:

Deep dive into credit scoring algorithms (e.g., FICO, VantageScore)

The 5 Cs of credit with case-based analysis

End-to-end loan origination process: application to disbursal

Risk-based pricing: how credit risk influences interest rates

Delinquency management, collections strategies, and recovery

Role of credit bureaus and credit reports

What people have said about Fundamentals of Credit...

⭐️⭐️⭐️⭐️⭐️ "This module was a game changer for me. I now understand credit scoring inside and out." — Janet S., Loan Officer

⭐️⭐️⭐️⭐️⭐️ "I used what I learned here to improve my own credit and negotiate better loan terms for my business." — Leo G., Entrepreneur

⭐️⭐️⭐️⭐️⭐️ "Credit risk assessment used to feel like a black box. This broke it down with clarity and real-world relevance." — Sara M., Compliance Analyst

✅ Forms of Business Structure

Detailed Overview: Examine the legal, operational, and financial impact of different business structures, especially in the context of banking and finance services.

What You’ll Learn:

Sole proprietorships vs. partnerships vs. corporations vs. LLCs

Tax obligations and liability for each structure

Impacts on funding: access to capital and investor preferences

Real-life case studies of startup vs. corporate financial decisions

Legal documentation and compliance requirements

What people have said about Forms of Business Structure...

⭐️⭐️⭐️⭐️⭐️ "I finally understand why some startups go for LLCs and others go straight to C-Corp. This was invaluable for my own planning." — Evan R., Aspiring Entrepreneur

⭐️⭐️⭐️⭐️⭐️ "The examples really helped me see how business structures impact financing, taxes, and liability. Super practical!" — Nina D., Tax Consultant

⭐️⭐️⭐️⭐️⭐️ "Clear, concise, and packed with real-world applications—especially the legal and funding implications of each structure." — Jordan K., MBA Student

✅ Accounting Fundamentals

Detailed Overview: Gain a solid understanding of accounting principles and how financial statements reflect the health of a business.

What You’ll Learn:

The accounting equation and double-entry bookkeeping

Structure of the income statement, balance sheet, and cash flow statement

Revenue recognition and matching principles

Accrual vs. cash accounting

Journal entries and trial balance preparation

Play to watch sample preview

What people have said about Accounting Fundamentals...

⭐️⭐️⭐️⭐️⭐️ "I used to avoid financial statements, but now I understand the story they tell. Big confidence booster!" — Monique P., Marketing Manager

⭐️⭐️⭐️⭐️⭐️ "Loved the section on the accounting equation and double-entry! It’s finally all making sense." — Alex N., Startup Founder

⭐️⭐️⭐️⭐️⭐️ "This module gave me the accounting base I needed to read income statements like a pro." — Deborah W., Sales Director

✅ Reading Financial Statements

Detailed Overview: This module helps you decode financial statements to assess performance, profitability, and solvency.

What You’ll Learn:

Structure and layout of the three main financial statements

Ratio analysis: liquidity, profitability, solvency, and efficiency

Common-size statements and trend analysis

Footnotes and disclosures interpretation

Cash flow analysis and earnings quality assessment

What people have said about Reading Financial Statements...

⭐️⭐️⭐️⭐️⭐️ "This module made financial statements click for me. I now read income statements like I read the news!" — Jamie S., Startup CFO

⭐️⭐️⭐️⭐️⭐️ "The ratio analysis section was pure gold. Helped me analyze a client’s health before onboarding." — Priya D., Relationship Manager

⭐️⭐️⭐️⭐️⭐️ "Understanding cash flow and earnings quality has changed how I look at companies. Best module so far!" — Nathan C., Retail Investor

✅ Introduction to Corporate Finance

Detailed Overview: Dive into how businesses manage capital, make investment decisions, and plan for long-term growth.

What You’ll Learn:

Capital budgeting: NPV, IRR, payback period

Cost of capital and WACC

Capital structure decisions and leverage

Dividend policy and share repurchases

M&A fundamentals and corporate valuation

What people have said about Introduction to Corporate Finance...

⭐️⭐️⭐️⭐️⭐️ "WACC, IRR, NPV—these used to be just acronyms. Now they’re tools I can confidently use at work." — Marcelo V., Finance Associate

⭐️⭐️⭐️⭐️⭐️ "The valuation techniques and investment decision-making frameworks were top-notch. Excellent module!" — Sheryl T., Venture Capital Analyst

⭐️⭐️⭐️⭐️⭐️ "This gave me the strategic lens to understand how CFOs think. A must for anyone climbing the finance ladder." — Aisha Q., Management Consultant

✅ Excel Crash Course for Finance Professionals

Detailed Overview: Accelerate your proficiency in Excel for financial modeling, data analysis, and automation.

What You’ll Learn:

Financial functions (NPV, IRR, PMT, FV)

VLOOKUP, INDEX/MATCH, conditional formatting

Pivot tables and dashboards

Charting techniques for financial storytelling

Scenario analysis, sensitivity analysis, and automation using Macros

What people have said about Excel Crash Course for Finance Professionals...

⭐️⭐️⭐️⭐️⭐️ "This was a game-changer. I finally feel fluent in Excel formulas and modeling basics!" — Kelvin Y., Junior Analyst

⭐️⭐️⭐️⭐️⭐️ "The hands-on examples made VLOOKUP, IF statements, and pivot tables second nature." — Renee L., Business Intelligence Intern

⭐️⭐️⭐️⭐️⭐️ "Every finance pro should take this—Excel mastery made easy and intuitive." — Toby W., Treasury Associate

✅ Capital IQ Fundamentals

Detailed Overview: Develop fluency in Capital IQ for equity research, valuation, and market screening.

What You’ll Learn:

Navigation and setup of Capital IQ dashboards

Data screening and filtering for companies and deals

Peer comparison and comp tables

Company profiles, credit ratings, and earnings estimates

Excel plugin for dynamic data pulling

What people have said about Capital IQ Fundamentals...

⭐️⭐️⭐️⭐️⭐️ "Capital IQ used to intimidate me. Now I can run comps and screen companies like a pro." — Samira A., Investment Banking Analyst

⭐️⭐️⭐️⭐️⭐️ "I finally understand how to extract clean financial data and market multiples for modeling." — Lee H., Equity Research Intern

⭐️⭐️⭐️⭐️⭐️ "This module saved me HOURS of work. Now I use Capital IQ confidently in my day job." — Christina M., Strategy Consultant

✅ Economics for Capital Markets

Detailed Overview: This module gives you a functional understanding of economics as it relates to global capital markets, helping you interpret economic data for investment and financial analysis.

What You’ll Learn:

Real-world interpretation of supply and demand using commodities and stock examples

The role of central banks (like the Fed, ECB) and their influence through interest rate policy, QE, and tapering

Inflation metrics: CPI, PPI, core vs. headline inflation, and their implications for investors

Business cycle navigation and how different asset classes perform across each phase

Case studies on how macroeconomic indicators (like unemployment or GDP reports) impact market pricing

Reading and interpreting central bank statements and policy guides

What people have said about Economics for Capital Markets...

⭐️⭐️⭐️⭐️⭐️ "I finally understand how interest rates affect stock prices and bond yields. This module cleared up years of confusion!" — Derek L., Junior Analyst

⭐️⭐️⭐️⭐️⭐️ "The macroeconomic case studies were pure gold—especially the walkthrough of past Fed decisions and market reactions." — Priya M., CFA Candidate

⭐️⭐️⭐️⭐️⭐️ "As someone from a non-finance background, this module gave me the clarity I needed to follow economic trends with confidence." — James W., Business Owner

✅ Math Fundamentals of Capital Markets

Detailed Overview: This module covers the quantitative backbone of capital markets, teaching you essential formulas and financial math used across investing and lending.

What You’ll Learn:

Time value of money, discounting, and compounding

Interest rate types: nominal, effective, simple, and compound

Yield calculations for bonds and savings products

Probability, normal distribution, and expected return

Basic Excel-based financial modeling techniques

What people have said about Math Fundamentals of Capital Markets...

⭐️⭐️⭐️⭐️⭐️ "The formulas are now second nature to me. The time value of money part was especially helpful!" — Tessa M., Finance Student

⭐️⭐️⭐️⭐️⭐️ "I’ve always been afraid of the math in finance, but this module made it simple and even enjoyable." — Andrew F., Business Analyst

⭐️⭐️⭐️⭐️⭐️ "Great mix of theory and Excel-based practicals. It helped me prep for my CFA Level 1 quant section." — Omar H., CFA Level 1 Candidate

✅ Introduction to Derivatives

Detailed Overview: Learn the foundational principles of derivatives markets and their practical uses in managing financial exposure and driving investment strategies.

What You’ll Learn:

What are forwards, futures, options, and swaps

How to construct simple hedging strategies (e.g., covered call, protective put)

Understanding options pricing and the Black-Scholes model basics

Margin requirements and clearinghouse roles

Real-world use cases: airlines hedging fuel costs, farmers hedging crop prices

What people have said about Introduction to Derivatives...

⭐️⭐️⭐️⭐️⭐️ "This module demystified options and futures for me. The hedging strategies were explained better than any finance class I’ve taken." — Luis G., Equity Trader

⭐️⭐️⭐️⭐️⭐️ "I finally get how airlines hedge fuel costs and how companies use swaps—brilliantly broken down!" — Carla B., Treasury Analyst

⭐️⭐️⭐️⭐️⭐️ "I used to skip any mention of derivatives. Now I feel confident discussing them with clients and using them in models." — Raymond T., Wealth Advisor

✅ Introduction to Business Intelligence

Detailed Overview: Understand the value of business intelligence tools and dashboards in financial reporting and strategy.

What You’ll Learn:

Basics of BI tools: Power BI, Tableau, Looker

Connecting financial datasets and building reports

Visualization principles for dashboards

Using KPIs to inform financial strategy

Automated reporting and drill-down analysis

Play to watch sample preview

What people have said about Introduction to Business Intelligence...

⭐️⭐️⭐️⭐️⭐️ "This opened my eyes to how finance teams are using BI tools for real-time insights." — Felix G., Corporate Finance Analyst

⭐️⭐️⭐️⭐️⭐️ "Data visualization techniques and KPIs dashboards were incredibly useful. Loved the Power BI intro!" — Jessica W., BI Specialist

⭐️⭐️⭐️⭐️⭐️ "Clear, actionable, and immediately useful. I applied BI insights to my financial reporting at work." — Greg B., Controller

✅ Data Science Fundamentals

Detailed Overview: Bridge the gap between finance and data science by learning core concepts and data manipulation.

What You’ll Learn:

Data types, collection methods, and data pipelines

Python/R basics for finance

Data cleaning and transformation

Introduction to data visualization

Data storytelling and real-world finance datasets

Play to watch sample preview

What people have said about Data Science Fundamentals...

⭐️⭐️⭐️⭐️⭐️ "For someone with zero background, this was the perfect intro to data science for finance!" — Ifeoma E., Risk Analyst

⭐️⭐️⭐️⭐️⭐️ "This helped me bridge the gap between finance and tech. The examples using real data were fantastic." — Paul T., Financial Data Scientist

⭐️⭐️⭐️⭐️⭐️ "Loved the clarity on data wrangling, preprocessing, and basic models—relevant and beginner-friendly." — Mira N., Quant Intern

✅ Statistics Fundamentals

Detailed Overview: Grasp essential statistics for financial analysis, including data interpretation and hypothesis testing.

What You’ll Learn:

Descriptive stats: mean, median, standard deviation

Correlation, regression, and distribution curves

Confidence intervals and p-values

Applications in portfolio analysis and market prediction

Statistical software basics (Excel, R)

What people have said about Statistics Fundamentals...

⭐️⭐️⭐️⭐️⭐️ "Explained in plain English! I finally get standard deviation, regression, and how to use them in finance." — Rebecca C., Data-Driven Financial Advisor

⭐️⭐️⭐️⭐️⭐️ "The probability and distribution sections helped me understand portfolio risk and Monte Carlo simulation." — Leo T., Quant Researcher

⭐️⭐️⭐️⭐️⭐️ "This gave me the confidence to back up investment ideas with real statistical analysis." — Neha M., Junior Investment Analyst

✅ Data Science and Machine Learning

Detailed Overview: Leverage AI/ML for advanced financial analytics, forecasting, and automation.

What You’ll Learn:

Supervised vs unsupervised learning

Algorithm types: regression, trees, clustering, NLP

Use cases in fraud detection, loan underwriting, and algo trading

Model validation and performance metrics

What people have said about Data Science and Machine Learning...

⭐️⭐️⭐️⭐️⭐️ "The applications to finance—like fraud detection and trading—were clearly explained with practical examples!" — Priya S., Junior Data Analyst

⭐️⭐️⭐️⭐️⭐️ "This module helped bridge the gap between coding and finance. I finally understand how machine learning models are applied in banks." — Daniel J., Quantitative Research Intern

⭐️⭐️⭐️⭐️⭐️ "The real-world use cases made complex ML concepts click. Great intro for anyone in financial services." — Olivia T., FinTech Developer

✅ Foreign Exchange Essentials

Detailed Overview: Learn how the foreign exchange market operates and its effects on international business.

What You’ll Learn:

Currency pairs, bid-ask spreads, and pips

Factors affecting exchange rates: inflation, interest rates, political risk

Types of FX transactions: spot, forward, swaps

FX hedging strategies using options and forwards

Real-world examples of corporate FX exposure

What people have said about Foreign Exchange Essentials...

⭐️⭐️⭐️⭐️⭐️ "Before this module, forex felt like a black box. Now I understand currency pairs, spreads, and how rates move." — Kevin J., Travel Industry Finance Manager

⭐️⭐️⭐️⭐️⭐️ "The real-world case studies on currency risk were eye-opening—especially for import/export businesses." — Amira S., International Trade Consultant

⭐️⭐️⭐️⭐️⭐️ "This demystified FX markets and gave me tools to hedge our firm’s overseas exposure confidently." — Yusuf B., Treasury Analyst

✅ Introduction to ESG (Environmental, Social, Governance)

Detailed Overview: Understand the growing importance of ESG factors in financial decisions and long-term investment strategies.

What You’ll Learn:

ESG scoring frameworks and providers (MSCI, Sustainalytics)

Green finance instruments: green bonds, impact investing

Regulatory landscape for ESG disclosures

Integrating ESG into portfolio construction

Case studies of ESG adoption and performance

What people have said about Introduction to ESG...

⭐️⭐️⭐️⭐️⭐️ "It’s rare to find such a comprehensive yet practical take on ESG investing. Excellent balance of theory and case studies!" — Sandra V., ESG Fund Manager

⭐️⭐️⭐️⭐️⭐️ "I appreciated how this explained the regulatory frameworks and how to assess ESG risk." — David R., Compliance Officer

⭐️⭐️⭐️⭐️⭐️ "Helped me understand what makes a company truly sustainable—beyond greenwashing." — Tania L., Sustainable Finance Enthusiast

✅ IBIS World

Detailed Overview: Learn how to use IBIS World for robust industry research and forecasting.

What You’ll Learn:

Market size, industry trends, and competitive landscape

Financial benchmarking using IBIS data

Strategic planning with SWOT and Porter’s Five Forces

Custom industry reports and data export features

What people have said about IBIS World...

⭐️⭐️⭐️⭐️⭐️ "Learning to extract strategic insights from IBIS World gave me an edge in client meetings." — Brandon K., Financial Consultant

⭐️⭐️⭐️⭐️⭐️ "The walkthroughs of industry reports were fantastic—made competitor analysis easy." — Claire S., Business Development Manager

⭐️⭐️⭐️⭐️⭐️ "Now I can confidently pull trends, growth forecasts, and key metrics by industry in minutes." — Mike H., Investment Analyst

✅ Commercial Banking Careers

Detailed Overview: Explore roles in commercial banking, career progression, and skill development.

What You’ll Learn:

Overview of relationship management, credit analysis, and operations

Required certifications (CFA, CBA, etc.)

Typical career paths and salary benchmarks

Day-in-the-life scenarios

Play to watch sample preview

What people have said about Commercial Banking Careers...

⭐️⭐️⭐️⭐️⭐️ "This helped me chart my path in commercial banking. I now know the skills I need and roles that fit me best." — Adrian W., College Graduate Exploring Finance

⭐️⭐️⭐️⭐️⭐️ "Real-life career stories and role breakdowns gave me confidence to pursue a relationship manager position." — Molly N., Aspiring Banker

⭐️⭐️⭐️⭐️⭐️ "This module should be required for every finance student considering banking—it’s that helpful." — Jacob F., Finance Undergrad

✅ Cryptocurrencies

Detailed Overview: Understand blockchain technology and its impact on banking and investment.

What You’ll Learn:

Blockchain mechanics and decentralization

Bitcoin, Ethereum, altcoins, and stablecoins

Wallets, exchanges, and security

Regulatory considerations

Crypto as an investment class

What people have said about Cryptocurrencies...

⭐️⭐️⭐️⭐️⭐️ "Best breakdown I’ve seen of how blockchain works and why crypto matters in finance today." — Isaiah M., Digital Asset Analyst

⭐️⭐️⭐️⭐️⭐️ "Helped me understand crypto beyond the hype—smart contracts, consensus mechanisms, everything." — Chloe R., Blockchain Enthusiast

⭐️⭐️⭐️⭐️⭐️ "I can now speak confidently about DeFi, NFTs, and crypto's impact on traditional banking." — Marco D., Innovation Strategist

✅ Analyzing Growth Drivers & Business Risks

Detailed Overview: Develop analytical skills to identify what drives growth and how to assess and mitigate risk.

What You’ll Learn:

Top-line vs bottom-line growth factors

SWOT analysis and PESTEL frameworks

Operational, market, and financial risk types

Forecasting methods and risk modeling

What people have said about Analyzing Growth Drivers & Business Risks...

⭐️⭐️⭐️⭐️⭐️ "Absolutely essential. Taught me how to critically evaluate what truly drives a business forward—or puts it at risk." — Marcus W., Private Equity Analyst

⭐️⭐️⭐️⭐️⭐️ "I now know how to assess growth potential and spot red flags before making an investment." — Jade P., Corporate Strategy Consultant

⭐️⭐️⭐️⭐️⭐️ "The business risk frameworks are gold—great for both analysts and entrepreneurs." — Hassan E., Financial Planner

✅ Vertical IQ Fundamentals

Detailed Overview: Harness Vertical IQ for sector-specific financial insights and client advisory.

What You’ll Learn:

Navigating industry profiles

Benchmarking KPIs for industries

Risk alerts and credit insights by sector

Sales prep reports and talking points for client engagement

What people have said about Vertical IQ Fundamentals...

⭐️⭐️⭐️⭐️⭐️ "This module took industry research to the next level—Vertical IQ saves me hours each week." — Tina M., Business Banker

⭐️⭐️⭐️⭐️⭐️ "It showed me how to pull unique insights that impress clients and deepen conversations." — Arjun R., Relationship Manager

⭐️⭐️⭐️⭐️⭐️ "Finally understand how to turn industry trends into actionable strategies!" — Carmen L., Sales Enablement Analyst

✅ Introduction to FinTech

Detailed Overview: Explore the disruptive trends and technologies transforming finance.

What You’ll Learn:

FinTech business models: neobanks, robo-advisors, P2P lending

Blockchain applications beyond crypto

RegTech, InsurTech, and embedded finance

Case studies of FinTech unicorns

Play to watch sample preview

What people have said about Introduction to FinTech...

⭐️⭐️⭐️⭐️⭐️ "This explained the entire fintech ecosystem—neobanks, robo-advisors, blockchain—without overwhelming me." — Eli K., Aspiring FinTech Founder

⭐️⭐️⭐️⭐️⭐️ "A fantastic overview of how technology is disrupting banking and what skills are in demand." — Nina V., Tech-Savvy Finance Student

⭐️⭐️⭐️⭐️⭐️ "Helped me understand the infrastructure powering everything from payments to crypto." — George M., Product Manager at Payment Startup

✅ Financial Analysis Fundamentals

Detailed Overview: Master core tools used in equity analysis, corporate finance, and investment banking.

What You’ll Learn:

Financial ratios: ROE, ROA, P/E, EV/EBITDA and more...

Trend, vertical, and horizontal analysis

Valuation techniques: DCF, comparables, precedent transactions

Earnings adjustments and normalized metrics

What people have said about Financial Analysis Fundamentals...

⭐️⭐️⭐️⭐️⭐️ "This gave me the tools to interpret financial ratios like a pro and confidently evaluate any company." — Samantha G., Senior Investment Analyst

⭐️⭐️⭐️⭐️⭐️ "The module's clear explanation of valuation methods really helped me on my job interviews!" — Ryan T., Corporate Finance Professional

⭐️⭐️⭐️⭐️⭐️ "With these skills, I can now break down financial statements quickly and with precision—no more guessing!" — Clara D., Financial Reporting Analyst

✅ Fundamentals of Data Analysis in Excel

Detailed Overview: Use Excel for data cleaning, visualization, and statistical analysis in finance.

What You’ll Learn:

Text-to-columns, data validation, and conditional logic

Charts, slicers, and dashboards

Regression and forecasting in Excel

Financial datasets analysis projects

What people have said about Fundamentals of Data Analysis in Excel...

⭐️⭐️⭐️⭐️⭐️ "I can now visualize data better and use Excel to perform financial analysis at work. So useful!" — Emma H., Data Analyst in Finance

⭐️⭐️⭐️⭐️⭐️ "The Excel shortcuts and functions taught here saved me hours—highly recommend this module." — Zachary B., Investment Associate

⭐️⭐️⭐️⭐️⭐️ "Excel was a bit intimidating at first, but this module made me feel like a pro with financial models." — Maya K., Junior Financial Analyst

✅ Trade Credit Fundamentals

Detailed Overview: Understand trade credit mechanisms and the assessment of buyer creditworthiness.

What You’ll Learn:

Trade finance instruments: letters of credit, invoice factoring

Days Sales Outstanding (DSO) and working capital impact

Credit insurance and export risk mitigation

Buyer vetting and credit limits

What people have said about Trade Credit Fundamentals...

⭐️⭐️⭐️⭐️⭐️ "Understanding trade credit risk and payment terms helped me manage cash flow better in my company." — Daniel L., Supply Chain Finance Specialist

⭐️⭐️⭐️⭐️⭐️ "The module gave me real-world strategies to optimize working capital by managing trade credit efficiently." — Jessica F., Credit Risk Manager

⭐️⭐️⭐️⭐️⭐️ "It was great to understand the nuances of trade credit, especially for international transactions." — Mohammed A., International Finance Manager

✅ Introduction to Risk Management

Detailed Overview: Explore how institutions identify, assess, and mitigate risks.

What You’ll Learn:

Types of financial risks: market, credit, operational, liquidity

Risk frameworks (COSO, ISO 31000)

Risk quantification tools: VaR, stress testing

Scenario planning and contingency frameworks

What people have said about Introduction to Risk Management...

⭐️⭐️⭐️⭐️⭐️ "Learning the risk management framework has helped me proactively identify and mitigate risks in my firm." — Carla N., Risk Officer

⭐️⭐️⭐️⭐️⭐️ "This module clarified risk identification and assessment in banking. Now I feel prepared to take on any challenge." — Simon W., Compliance Manager

⭐️⭐️⭐️⭐️⭐️ "I’ve used this knowledge to create stronger risk mitigation strategies for my company’s operations." — Liam D., Operational Risk Analyst

✅ Equity Allocation for Wealth Managers

Detailed Overview: Understand how wealth managers allocate equity in diversified portfolios.

What You’ll Learn:

Portfolio theory basics (CAPM, efficient frontier)

Sector rotation and thematic investing

Asset allocation models: strategic vs tactical

Rebalancing strategies and risk profiling

Play to watch sample preview

What people have said about Equity Allocation for Wealth Managers...

⭐️⭐️⭐️⭐️⭐️ "This module gave me the expertise to better diversify portfolios and explain asset allocation to my clients." — Karen P., Wealth Manager

⭐️⭐️⭐️⭐️⭐️ "I learned how to create well-balanced portfolios based on clients' risk preferences and market outlook." — Raj S., Financial Advisor

⭐️⭐️⭐️⭐️⭐️ "This module is a game-changer. I now feel confident in recommending optimal equity allocations." — Oliver J., Portfolio Manager

Here's what other people had to say after going through the course...

✅ 7. “Learned More Than in a Whole Semester”

⭐️⭐️⭐️⭐️⭐️ "I did a finance course in university, but this was more structured and practical. Even the ESG and credit modules went deeper than my college class."— Lara J., Finance Student

✅ 8. “No Finance Degree Needed”

⭐️⭐️⭐️⭐️⭐️ "I’m self-taught in finance, and this gave me the structure I lacked. From understanding derivatives to interpreting cash flow statements — finally, a course that speaks plain English."— James E., Aspiring Analyst

✅ 9. “Excel Module Helped Me Get a Raise”

⭐️⭐️⭐️⭐️⭐️ "The Excel training is worth the price alone. I revamped our company’s forecasting tool based on what I learned. My boss was so impressed, I got a raise."— Sheila M., Operations Analyst

✅ 10. “The Confidence Boost I Needed”

⭐️⭐️⭐️⭐️⭐️ "I used to feel left out when finance came up in meetings. Now, I’m the one explaining things. This course changed how I think — and how I’m seen at work."— Kevin N., Career Switcher

🔥 Course Price & Enrollment Options

Full Course Access:

$997(₦1,500,000)$497 (₦750,000)

📢 Limited Offer: Enroll Today & Get 50% Off! ($497)

Hurry and get this now before it becomes unavailable or the price goes up!

🔴 Enroll Now & Start Learning!

ABOUT

MarketPlacie is a premiere platform that provides access to the hottest and best products and services from the biggest brands on the planet

hello@marketplacies.com

Powered by RPBCS